Announcement

Collapse

No announcement yet.

ARM ROOM นั่งคุยเรื่อง arm และ risc tecnology

Collapse

X

-

ประสิทธิภาพรองรับเรเทรซซิ่งด้วย ดูกันต่อว่าอนาคตจะพัฒนาเป็นแทบเล้ต โน้ตบุ้คกันต่อได้ไหม

Comment

-

ประตูเมืองจะเปิดแล้วนะ

หลุดแอป Android ลง Windows 11 กว่า 1,000 แอปได้แล้ววันนี้

https://www.beartai.com/news/itnews/958545

ศุภกานต์ เหล่ารัตนกุล 21/02/2022

ปล่อยให้รอมาอย่างยาวนานกับการใช้งานแอป Android บน Windows 11 หลังจากเปิดตัวไปเมื่อปีที่แล้ว ปล่อยให้นักพัฒนาทดสอบกันเรียบร้อยแล้ว ล่าสุดไมโครซอฟท์ (Microsoft) ได้ประกาศผ่านบล็อก เปิดให้ผู้ใช้งานทั่วไปสามารถดาวน์โหลดแอป Android เพื่อใช้บน Windows 11 ได้แล้วผ่าน Amazon Appstore

ไมโครซอฟท์ระบุว่าผู้ใช้จะสามารถดาวน์โหลดแอปและเกม Android ที่มีอยู่ใน Amazon Appstore กว่า 1,000 แอป ได้โดยตรงผ่าน Microsoft Store

Amazon Appstore Preview นี้จะสามารถเข้าถึงได้ใน Microsoft Store เวอร์ชันล่าสุดก่อน โดยในช่วงแรกนี้จะยังเป็นตัว Amazon Appstore Preview ซึ่งจะสามารถเข้าได้เฉพาะผู้ใช้ Windows 11 ที่ตั้งภูมิภาคเป็นสหรัฐอเมริกาเท่านั้น

ทั้งนี้แอป Android ที่สามารถรันบน Windows 11 ได้นั้น ยังมีอยู่จำกัด เพราะไม่สามารถเข้าถึง Google Play Store อย่างเป็นทางการได้ สามารถใช้งานได้เข้ากับ Windows 11 ได้ดี ในฟีเจอร์ต่าง ๆ เช่นการ Snap

Comment

-

ซวยล่ะพี่น้อง ข่าวว่าตอนนี้ถึงสงครามจะเหมือนไม่มีผลกระทบ เพราะใช้ของจาก ยูเครน รัสเซียแค่ 20%

แต่ NEON กับ Palladium ยังขาดนะนาย แถมยังหาแหล่งทดแทนในระยะนี้ยังไม่ได้ด้วย

อดเล่นเกมส์ไปสักพักนะพี่น้อง

Amid Ukraine fallout, crisis-hardened chipmakers move to adapt

Semiconductor manufacturers are stockpiling materials and seeking out new suppliers to minimise disruptions.

Chipmakers like TSMC are racing to adapt to the fallout of the war in Ukraine [File: Tyrone Siu/Reuters]By Liam Gibson

Chipmakers like TSMC are racing to adapt to the fallout of the war in Ukraine [File: Tyrone Siu/Reuters]By Liam Gibson

Published On 3 Mar 20223 Mar 2022

Taipei, Taiwan – As war in Eastern Europe shakes global markets, chipmakers appear confident the already-stretched industry can sustain interruptions from the conflict.

Despite concerns over shocks to the supply of material inputs – mainly neon gas and palladium – firms in East Asia and North America are showing the capacity to adapt. Many semiconductor manufacturers, which provide critical components for electronic devices used in countless industries, anticipated disruptions and are minimizing the effects either through stockpiling, process innovation, or sourcing from new suppliers.

KEEP READING

list of 4 itemslist 1 of 4Million refugees flee Ukraine; Russia faces ICC probe: Live news

list 2 of 4Breonna Taylor killing: Ex-cop says he did nothing wrong in raid

list 3 of 4People of colour struggle to escape Russian invasion of Ukraine

list 4 of 4ICC to begin investigation into possible war crimes in Ukraine

end of list

A lack of exposure to the Russian market is also sheltering the industry from a sudden hit to revenue, though the conflict is expected to damage the long-term growth prospects for what had been a promising upper middle-income market.

The fog of war clouds what other knock-on effects may lurk around the corner. Yet, after operating in a climate of high uncertainty amid trade wars and pandemics in recent years, chipmakers have learned to expect the unexpected and plan accordingly. The war in Ukraine could be the next step in building the industry’s resilience to crises.

Research firm Techcet raised the alarm in early February with a report highlighting key materials obtained from Ukraine and Russia – including C4F6, palladium, helium, and, chief among them, neon gas, of which the United States imports 90 percent from Ukraine. The following week Joe Pasetti, VP at SEMI, a semiconductor suppliers group, sent an email to its members warning its members to review supply chains and make preparations where they were most vulnerable.

But as hostilities broke out, the industry’s big players, including SK Hynix, United Microelectronics, GlobalFoundries, ASE, Intel, and Micron, each made statements assuring investors they could handle the risk.

“The industry learned its lessons in 2014,” Sravan Kundojjala, an analyst at Strategy Analytics told Al Jazeera, referring to Russia’s takeover of Crimea which triggered a 600 percent spike in neon gas prices.

The disruption, Kundojjala said, led Dutch firm ASML to dramatically reduce the amount of neon gas needed in their industry-standard DUV lithography machines by between 30 and 50 percent.

Semiconductors are a central component of electronic devices used in a vast array of sectors, including communications, computing, healthcare, defence, and transportation

Semiconductors are a central component of electronic devices used in a vast array of sectors, including communications, computing, healthcare, defence, and transportation

[File: Qilai Shen/Bloomberg]

“The reliance on Russia and Ukraine for materials has lessened over the years since,” Mario Morales, an analyst at market research firm IDC, told Al Jazeera.

“However, existing supply constraints and recent disruptions on logistics and transport keep the supply chain on alert,” Morales added, noting power management ICs (PMICs) and other analog and mixed-signal chips will have less tolerance to supply chain shocks.

Jeff Ferry, chief economist at the Coalition for a Prosperous America and former industry exec, stressed the importance of further supply diversification, saying mining alternative sources for materials is more viable than reengineering processes that semiconductor suppliers like ASML use.

Indeed, diversification has helped. ASML said last week that it now sources less than 20 percent of neon gas from Russia and Ukraine. Micron also is reworking its supplies.

Taiwanese firms seem to be pivoting too.

“Russian and Ukraine are not the only sources of key materials for Taiwanese companies, which also procure from other sources such as China,” Joanne Chiao, an analyst at Taipei-based Trend Force, told Al Jazeera.

Chiao said Taiwanese firms are generally carrying a safe level of inventory as a backup measure. South Korea’s SK Hynix has also stockpiled in preparation.

Beyond material security, chipmakers are also looking to manage their exposure to Russian markets.

$25bn electronics market

The main concern is not so much how economic sanctions will hurt direct semiconductor sales – Russia had little appetite for chips, to begin with, accounting for less than 0.1 percent of global consumption. It is more the war’s impact on its broader electronics market, valued at $25bn.

Apple announced it would halt all product sales to Russia days after Ukrainian leaders wrote an open letter to CEO Tim Cook requesting he pull the plug. Though Samsung, the most popular brand in Russia, has not announced its own ban, the South Korean company may need to apply for permission from the US to sell its handsets since its government was slow in joining Washington-led sanctions when the war first broke.

Questions remain over whether the US Department of Commerce will include smartphones – a market valued at $2.8bn in Russia at the end of last year –among the sanctioned strategic items.

Even if market access can be clinched, soaring prices seem certain to dent consumer sentiment.

Apple has halted sales of its products in Russia following Moscow’s invasion of Ukraine [File: Bloomberg]

Apple has halted sales of its products in Russia following Moscow’s invasion of Ukraine [File: Bloomberg]

Before Apple announced its ban, Chiao noted the price of the iPhone 13 Pro 128GB had risen by more than 50 percent since the conflict began due to foreign exchange rate fluctuations.

This will lead Russians to spend less on the latest gadgets, she said, and focus on daily necessities, which could prompt a drastic decline in demand for chips. This could prompt integrated circuit design houses to reduce their wafer input at foundries, she said.

Though Russia’s large market potential was underdeveloped, with a growing population and an expected 124 million internet users by 2025, it had untapped potential. The conflict will create an unquantifiable loss of potential growth from an emerging market that was entering upper-middle-income country status, a phase that usually spurs consumption in electronics.

Now, if 20 percent of Russian gross domestic product is wiped out as some economists predict, this will have major long-term ramifications for the chip industry, especially if the conflict continues, Ferry said.

“In the short term we’ll be OK, but if this war drags on, that could cause us problems,” he said.

Ferry said all consumer chipmakers will feel the effects, although the impact will pale in comparison to the effects of any comparable situation involving China – another military power whose irredentist aggression is stirring fears of war.

Indeed, Taiwan’s TSMC, the world’s largest contract chipmaker, lost bigger Chinese clients than the Russian market and walked it off fine, Kundojjala said.

He pointed out the firm lost $4.5bn in 2020 – about 12 percent of its total revenue – when the US banned exports to High Silicon, Huawei’s semiconductor subsidiary, but that demand from other firms quickly absorbed the loss, and TSMC made 25 percent higher revenue in 2021.

So while TSMC can live without Russia, it is not clear whether Russia can do the same. Though Taiwan exports few chips to Russia, some have strategic value, such as Elbrus-branded chips, which are designed in Russia and used in the country’s military and cyber technology.

Lack of alternatives

Moscow could struggle to get them made elsewhere anytime soon.

“Although Chinese foundries are able to provide the 1Xnm and more mature process technologies used for Elbrus chip production, the redesign and verification processes will take these foundries at least one year,” Chiao said.

“Hence, it is difficult for Russia to reassign Elbrus production to Chinese foundries immediately.”

“SMIC is an option,” Kundojjala said, referring to China’s largest state-owned chipmaker.

Yet, because SMIC relies on ASML for lithography and American firms for other critical equipment, they could risk regulatory punishment for breaking US sanctions on supplying Russia with chips, which extend to any company that uses American technology in its processes.

With China still reliant on American tech for its chipmaking capacity, it is unlikely they would take such a risk for a relatively small client for now, Kundojjala said.

This could change if China’s attempts to forge a self-reliant ecosystem by harnessing carbon chips or other nascent technologies pay off though.

Such strategic reshoring is what the US should double down on, according to Ferry. He said corporate America must move beyond looking for the cheapest destinations and partner with strong, reliable allies, and aggressively decouple from China, Russia and other hostile states.

“We are recognizing that we live in a hostile, unpredictable… ‘‘post-neo-liberal world.’”

Comment

-

มาแว้ว...............................................................

Firefly's Mini-ITX ITX-3588J Is The Hulk to Raspberry Pi's Bruce Banner

Powered by Rockchip RK3588 new-gen 8-core 64-bit processor, the mainboard can be configured with up to 32GB RAM. Capable of 8K video encoding and decoding, it provides abundant interfaces supporting multiple hard disks, Gigabit Ethernet, WiFi6, 5G/4G expansion and a variety of video input and output. It supports different power supply ways and various operating systems. This mainboard can be used in ARM PC, edge computing, cloud server, smart NVR and other fields.

Powered by Rockchip RK3588 new-gen 8-core 64-bit processor, the mainboard can be configured with up to 32GB RAM. Capable of 8K video encoding and decoding, it provides abundant interfaces supporting multiple hard disks, Gigabit Ethernet, WiFi6, 5G/4G expansion and a variety of video input and output. It supports different power supply ways and various operating systems. This mainboard can be used in ARM PC, edge computing, cloud server, smart NVR and other fields.

https://www.tomshardware.com/news/it...board-is-a-lot

By Ian Evenden published 2 days ago

A Mini-ITX motherboard has been revealed by Firefly featuring the powerful eight-core Rockchip RK3588 SoC, and enough ports to make a proper PC out of the Arm-based powerhouse. But the goal of this board is to be the brains in your AI projects.

See more

As we saw from the recent Banana Pi board announcement, the RK3588 is an extremely capable chip. Four of its cores use Arm's Cortex A76 architecture, as seen in the Qualcomm Snapdragon 855 SoC used in smartphones such as the Samsung Galaxy Fold and Black Shark 2 gaming phone. The other four cores are Cortex A55-based, which are 15 percent more efficient than the A53 cores they replace. The GPU is a quad-core Mali-G610, and there's an NPU offering 6 Tops of neural computing power for applications such as TensorFlow and MXnet. It's a solid offering in a small package, especially considering you can spec as much as 32GB of RAM.

Comment

-

ช่วงนี้ฝั่ง arm น่าจะรอๆๆๆ amd sumsunmg ครับเงียบๆๆ แต่ที่จริงมือถือขายดี เรือ่ยๆๆ

ฝั่ง แอนดรอยด์ คงต้องรอชม Cortex X2

ARM ประกาศเปิดตัว CPU ชุดใหม่ ที่พัฒนาบนพื้นฐาน ARMv9 ตั้งแต่รุ่นท็อปสุด Cortex-X2 รุ่นกลาง Cortex-A710 และรุ่นประหยัดพลังงาน Cortex-A510 ประสิทธิภาพแรงขึ้น กินไฟน้อยลงกว่าเดิม นอกจากนี้ ARM ยังขนเอา GPU ตระกูล Mali รุ่นใหม่ ๆ มาให้พวกเราได้ยลโฉมกันอีกเพียบ คาดสมาร์ทโฟนรุ่นต่าง ๆ นำไปใช้ในช่วงต้นปีหน้า Cortex-X2 ถือเป็น CPU รุ่นที่พัฒนาต่อยอดมาจากตัวแรง Cortex-X1 ที่พบเจอได้ใน Snapdragon 888 หรือ Exynos 2100 ชิปเซ็ตตัวท็อป ๆ ของตลาด ณ ปัจจุบัน ตรงนี้ ARM เผยว่า Cortex-X2 จะแรงขึ้นกว่าเดิม 16% และ ARM ได้ปรับเพิ่มประสิทธิภาพ Machine Learning ให้ตัว CPU...

ARM ประกาศเปิดตัว CPU ชุดใหม่ ที่พัฒนาบนพื้นฐาน ARMv9 ตั้งแต่รุ่นท็อปสุด Cortex-X2 รุ่นกลาง Cortex-A710 และรุ่นประหยัดพลังงาน Cortex-A510 ประสิทธิภาพแรงขึ้น กินไฟน้อยลงกว่าเดิม นอกจากนี้ ARM ยังขนเอา GPU ตระกูล Mali รุ่นใหม่ ๆ มาให้พวกเราได้ยลโฉมกันอีกเพียบ คาดสมาร์ทโฟนรุ่นต่าง ๆ นำไปใช้ในช่วงต้นปีหน้า Cortex-X2 ถือเป็น CPU รุ่นที่พัฒนาต่อยอดมาจากตัวแรง Cortex-X1 ที่พบเจอได้ใน Snapdragon 888 หรือ Exynos 2100 ชิปเซ็ตตัวท็อป ๆ ของตลาด ณ ปัจจุบัน ตรงนี้ ARM เผยว่า Cortex-X2 จะแรงขึ้นกว่าเดิม 16% และ ARM ได้ปรับเพิ่มประสิทธิภาพ Machine Learning ให้ตัว CPU...

Comment

-

Nvidia ยึดอาร์มไม่ได้ รอดูว่าพี่เขียวเค้าจะดันเทคโนโลยี่อาร์มอะไร

ออกมาแทนในฐานะ ผุ้พัฒนาโปรเซสเซอร์ ARM

ป้าลิซ่า ยิ้มแฉ่ง ดีล อาร์ม ล่ม แต่ แดงได้ Xilink มาครอง ปลายปี

ขอ 5 nm ไร้เส้นให้ได้นะป้า ให้เหมือนตอนไรเซ่น 3000 ล่ะ

สาวกทิดอิน บางคน มีดิ้นๆๆๆ หยาบคายอีก เอิ้กๆๆๆ

Comment

-

ไปตามข่าวสงงครามแวะมาเจอคนด่าเฉย

ไม่มามือเปล่า ล่าสุด SK HYNIX สนใจจะลุ้นซื้อ ARM มั่งล่ะ

ในขณะที่ Softbank ก็หน้าเลือดจะขึ้นราคาเป็น 6 หมื่นล้าน USD ( 60 BN )

SK Hynix says it is reviewing acquiring Arm

https://www.datacenterdynamics.com/e...acquiring-arm/

South Korean chipmaker SK Hynix says that it is considering forming a consortium with strategic investors to acquire Arm.

The idea is still in early stages, and comes as Arm prepares for a roughly $60bn initial public offering (IPO).

– SK hynix

"We are reviewing possibly forming a consortium, together with strategic partners, to jointly acquire [Arm]," said Park Jung-ho, vice chairman and CEO of SK hynix, said per the Yonhap news agency.

"I don't believe Arm is a company that could be bought by one company."

One company did try: Nvidia in 2020 announced it would buy Arm for $40bn, a price that jumped to around $60bn thanks to Nvidia's share price increasing in value.

But the deal collapsed due to aggressive regulatory pushback.

When the deal fell apart in February, Arm appointed Arm IP Products Group head Rene Haas as CEO.

A month later, the company said that it would lay off 12-15 percent of its staff, putting 1,000 jobs at risk.

"I want to buy Arm, if not entirely," Park Jung-ho said. "It doesn't have to be buying a majority of its shares to be able to control the company."

SK Hynix primarily develops dynamic random-access memory (DRAM) chips and flash memory chips, and is one of the world's largest semiconductor companies.

Earlier this week, South Korean antitrust regulators approved SK Hynix's acquisition of local chipmaker Key Foundry, which makes chips for power management, display drivers and microcontroller unit semiconductors.

Around two percent of SK Hynix's revenue comes from sales of non-memory products and its foundry business, with the Key Foundry acquisition expected to double thatReport: SoftBank to pick Goldman Sachs for $60bn Arm IPO

After Nvidia deal fell to pieces

March 25, 2022 By Sebastian Moss Comment

FacebookTwitterLinkedInRedditEmailShare

SoftBank plans to pick Goldman Sachs Group as the lead underwriter on the initial public offering of Arm.

Reuters reports that the company is looking to value the chip designer by as much as $60 billion.

– Open Grid Scheduler / Grid Engine

The IPO comes after SoftBank's deal to sell Arm to Nvidia collapsed as US and European regulators threatened to block the sale. That deal was originally valued at $40 billion, but grew in value to around $60bn thanks to Nvidia's share price increasing in value.

When the deal fell apart in February, Arm appointed Arm IP Products Group head Rene Haas as CEO.

A month later, the company said that it would lay off 12-15 percent of its staff, putting 1,000 jobs at risk.

Arm also has begun to ask the banks vying for the listing to underwrite a margin loan of about $8 billion, Bloomberg reports.

"We will aim for the biggest IPO ever in semiconductor history," SoftBank founder Masayoshi Son told investors last month.

Comment

-

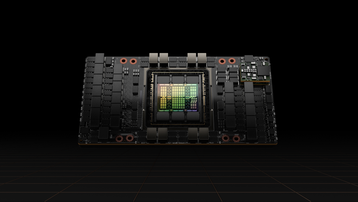

ไม่ได้เข้าห้อง VGA นะครับ แต่เอามาฝาก NVIDIA HOPPER อาจะเป็น RTX-4000

ตอนนี้จะออกเป็น Compute GPU H100 ซึ่งมีจำนวน Transistor เพิ่มขึ้น 68%

เป็นไปได้ว่า RTX-4000 ก็คงจะมี CUCA CORE เพิ่มขึ้นด้วย และผลิตที่ 4NM นะ

Nvidia reveals new Hopper H100 GPU, with 80 billion transistors

68 percent more transistors than the A100

March 23, 2022 By Sebastian Moss Comment

FacebookTwitterLinkedInRedditEmailShare

Nvidia has announced a new GPU based on its upcoming Hopper architecture.

The Hopper architecture replaces Ampere, which has more than $10 billion sales to date. The H100 GPU is the first chip based on Hopper, and is designed for AI and supercomputing workloads in the data center.

– Nvidia

The H100 GPU is manufactured on a 'custom version' of TSMC’s 4N process, with 80 billion transistors - 68 percent more than the prior-generation 7nm A100 GPU. It is the first GPU to support PCIe Gen5 and the first to utilize HBM3, enabling 3TB/s of memory bandwidth.

The new GPU provides up to 30 teraflops of peak standard IEEE FP64 performance, 60 teraflops of peak FP64 tensor core performance, and 60 teraflops of peak FP32 performance.

The H100 GPU includes a 'Transformer Engine' component that’s designed to speed up specific categories of AI models.

“Data centers are becoming AI factories — processing and refining mountains of data to produce intelligence,” Nvidia founder and CEO Jensen Huang said.

“Nvidia H100 is the engine of the world’s AI infrastructure that enterprises use to accelerate their AI-driven businesses.”

Comment

-

ฝากตามข่าวด้วยครับท่าน ดีลไม่จบ เร่ขายOriginally posted by ssk View Post[B][U]ไม่ได้เข้าห้อง VGA นะครับ แต่เอามาฝาก NVIDIA HOPPER อาจะเป็น RTX-4000

ตอนนี้จะออกเป็น Compute GPU H100 ซึ่งมีจำนวน Transistor เพิ่มขึ้น 68%

เป็นไปได้ว่า RTX-4000 ก็คงจะมี CUCA CORE เพิ่มขึ้นด้วย และผลิตที่ 4NM นะ

หาเถ้าแก่อาร์มกันต่อ 55

Comment

Comment